Chapter 2 of “Managerial Accounting: An Introduction to Concepts, Methods, and Uses” focuses on the methods for measuring product costs. This chapter is fundamental for understanding how costs are assigned to products, which is crucial for pricing, profitability analysis, and inventory valuation.

Key Topics in Chapter 2

- Product Costs in Manufacturing:

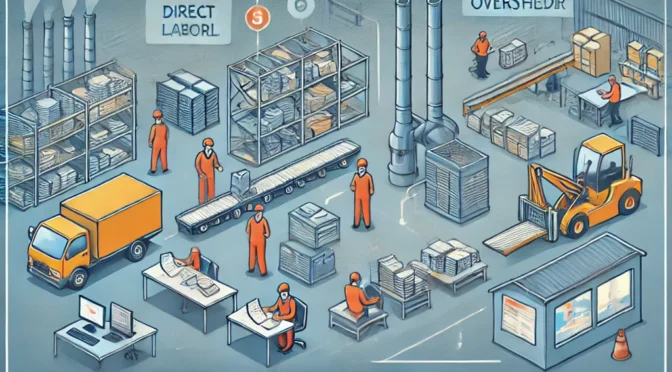

- Product costs, also known as inventoriable costs, are those directly associated with the production of goods. These costs include direct materials, direct labor, and manufacturing overhead.

- Understanding product costs is essential for determining the cost of goods sold (COGS) and ending inventory values on the balance sheet.

- Types of Costing Systems:

- Job Order Costing: Used when products are customized or produced in small batches. Costs are tracked by job or order, and each job has its own set of costs.

- Process Costing: Used when products are homogeneous and produced on a continuous basis. Costs are accumulated by process or department and averaged over the number of units produced.

- Direct and Indirect Costs:

- Direct Costs: Costs that can be directly traced to a specific product, such as raw materials and labor.

- Indirect Costs (Overhead): Costs that cannot be directly traced to a specific product and are allocated across multiple products or departments.

- Allocation of Manufacturing Overhead:

- Overhead costs are allocated to products using a predetermined overhead rate. This rate is calculated based on estimated costs and a selected allocation base, such as direct labor hours or machine hours.

- Cost Flow Assumptions:

- The chapter discusses various cost flow assumptions (FIFO, LIFO, Weighted Average) that affect inventory valuation and COGS calculation, particularly in process costing systems.

- Calculating Unit Costs:

- The unit cost is the total cost divided by the number of units produced. This calculation is critical for setting prices and analyzing profitability.

Math Problem and Solution from Chapter 2

To illustrate the application of these concepts, let’s consider a problem involving Job Order Costing.

Problem:

A manufacturing company, ABC Manufacturing, uses a job order costing system. For Job #101, the company incurred the following costs:

- Direct Materials: $10,000

- Direct Labor: 200 hours at $25 per hour

- Manufacturing Overhead: Applied at a rate of $30 per direct labor hour

Calculate the total cost of Job #101 and the unit cost if the job produced 500 units.

Solution:

- Direct Materials Cost:

The direct materials cost for Job #101 is given as: $$

\text{Direct Materials Cost} = 10,000

$$ - Direct Labor Cost:

The direct labor cost is calculated by multiplying the number of labor hours by the hourly wage rate. $$

\text{Direct Labor Cost} = \text{Labor Hours} \times \text{Wage Rate}

$$ Substituting the given values: $$

\text{Direct Labor Cost} = 200 \times 25 = 5,000

$$ - Manufacturing Overhead:

The manufacturing overhead is applied based on direct labor hours at a rate of $30 per hour. $$

\text{Manufacturing Overhead} = \text{Labor Hours} \times \text{Overhead Rate}

$$ Substituting the values: $$

\text{Manufacturing Overhead} = 200 \times 30 = 6,000

$$ - Total Cost of Job #101:

The total cost of Job #101 is the sum of direct materials, direct labor, and manufacturing overhead. $$

\text{Total Cost of Job #101} = \text{Direct Materials Cost} + \text{Direct Labor Cost} + \text{Manufacturing Overhead}

$$ Substituting the calculated values: $$

\text{Total Cost of Job #101} = 10,000 + 5,000 + 6,000 = 21,000

$$ - Unit Cost:

The unit cost is the total cost divided by the number of units produced. $$

\text{Unit Cost} = \frac{\text{Total Cost of Job #101}}{\text{Number of Units Produced}}

$$ Substituting the given number of units: $$

\text{Unit Cost} = \frac{21,000}{500} = 42

$$

Conclusion

Understanding how to measure and allocate product costs is crucial for pricing, cost control, and financial reporting. The example of Job #101 demonstrates the use of a job order costing system to calculate total and unit costs, which can guide managerial decisions on pricing and profitability.