Chapter 13 of “Managerial Accounting: An Introduction to Concepts, Methods, and Uses” focuses on the allocation of costs to various responsibility centers within an organization. A responsibility center is a part of an organization whose manager is responsible for a particular set of activities. Proper cost allocation is crucial for accurate performance evaluation, budgeting, and decision-making.

Key Topics in Chapter 13

- Understanding Responsibility Centers:

- Responsibility centers are segments within an organization, classified based on the level of responsibility managers have over costs, revenues, or investment in assets. The main types are:

- Cost Centers: Responsible only for controlling costs (e.g., a manufacturing department).

- Revenue Centers: Responsible for generating revenue (e.g., a sales department).

- Profit Centers: Responsible for both revenues and costs, hence profitability (e.g., a product line).

- Investment Centers: Responsible for revenues, costs, and the investment in assets used to generate profits (e.g., a division of a company).

- Principles of Cost Allocation:

- The process of cost allocation involves assigning indirect costs (overhead) to different responsibility centers. The primary principles of cost allocation include:

- Causality: Costs should be allocated based on the cause-and-effect relationship. This principle ensures that costs are assigned to centers based on their consumption of resources.

- Benefits Received: Costs should be allocated to the centers that receive the benefits of the expenses.

- Fairness and Equity: Cost allocation should be perceived as fair by all responsibility centers. This can be more subjective and depends on organizational culture.

- Ability to Bear: Costs can be allocated based on the ability of a responsibility center to bear them, which often relates to the center’s size or profitability.

- Methods of Cost Allocation:

- Direct Allocation Method: Allocates costs directly to the responsibility centers that incur them, without allocating any support department costs to other support departments.

- Step-Down Allocation Method: Allocates costs to both operating and support departments in a step-by-step manner, where some support department costs are allocated to other support departments.

- Reciprocal Allocation Method: Recognizes the mutual services provided among all support departments and allocates costs accordingly. This method is the most accurate but also the most complex.

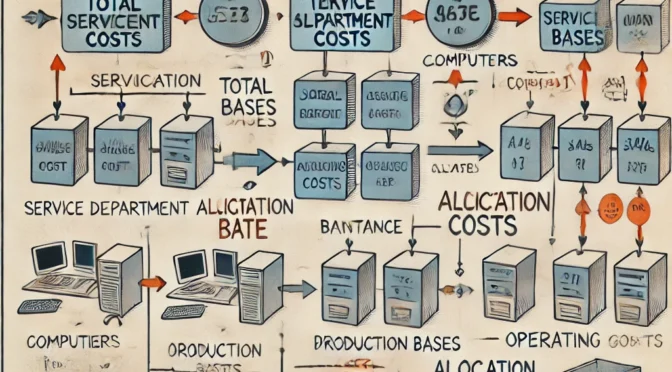

- Allocating Service Department Costs:

- Service departments (e.g., IT, HR) provide services to other parts of the organization. The costs of these departments need to be allocated to the operating departments to determine the total cost of providing goods or services.

- The chapter discusses various methods for allocating service department costs, such as using direct labor hours, machine hours, or square footage as allocation bases.

- Activity-Based Costing (ABC) for Cost Allocation:

- Activity-Based Costing is a more refined approach that assigns costs based on activities that drive costs. It involves identifying activities, assigning costs to these activities, and then allocating costs to products or services based on their consumption of those activities.

Math Problem and Solution from Chapter 13

To illustrate the Direct Allocation Method of allocating service department costs, consider the following problem:

Problem:

XYZ Corporation has two service departments, IT and Maintenance, and two operating departments, Production and Sales. The costs for IT and Maintenance are $100,000 and $50,000, respectively. The allocation bases are:

- IT costs are allocated based on the number of computers: Production has 60 computers, Sales has 40 computers.

- Maintenance costs are allocated based on square footage: Production occupies 2,000 square feet, Sales occupies 1,000 square feet.

Allocate the service department costs to the operating departments using the Direct Allocation Method.

Solution:

- Calculate the Allocation Rate for IT Costs: The allocation rate for IT costs is calculated based on the number of computers. $$

\text{IT Allocation Rate per Computer} = \frac{\text{Total IT Costs}}{\text{Total Number of Computers}}

$$ Total number of computers = 60 (Production) + 40 (Sales) = 100 $$

\text{IT Allocation Rate per Computer} = \frac{100,000}{100} = 1,000

$$ - Allocate IT Costs to Production and Sales:

- Production: $$

\text{IT Costs for Production} = 60 \times 1,000 = 60,000

$$ - Sales: $$

\text{IT Costs for Sales} = 40 \times 1,000 = 40,000

$$

- Calculate the Allocation Rate for Maintenance Costs: The allocation rate for Maintenance costs is calculated based on square footage. $$

\text{Maintenance Allocation Rate per Square Foot} = \frac{\text{Total Maintenance Costs}}{\text{Total Square Footage}}

$$ Total square footage = 2,000 (Production) + 1,000 (Sales) = 3,000 $$

\text{Maintenance Allocation Rate per Square Foot} = \frac{50,000}{3,000} = 16.67

$$ - Allocate Maintenance Costs to Production and Sales:

- Production: $$

\text{Maintenance Costs for Production} = 2,000 \times 16.67 = 33,340

$$ - Sales: $$

\text{Maintenance Costs for Sales} = 1,000 \times 16.67 = 16,670

$$

- Total Allocated Costs:

- Production: IT ($60,000) + Maintenance ($33,340) = $93,340

- Sales: IT ($40,000) + Maintenance ($16,670) = $56,670

Conclusion

Chapter 13 emphasizes the importance of proper cost allocation in accurately measuring the performance of responsibility centers. By using methods such as the Direct Allocation Method, Step-Down Method, and Reciprocal Method, organizations can ensure that costs are fairly and accurately assigned to the appropriate departments. This enables better decision-making, budgeting, and performance evaluation, ultimately leading to more efficient and effective management of resources.